Everyday pocket change often goes unnoticed, passed from hand to hand without much thought. Yet, hidden among the coins we casually spend could be treasures worth thousands of dollars. One striking example is a rare nickel that sold for an astonishing $88,125 at auction. This sale not only highlights the incredible value that certain coins can hold but also sparks curiosity about what makes a coin so special. For collectors, investors, and even casual enthusiasts, understanding the features that elevate a coin from ordinary currency to a prized collectible is essential. This article explores the fascinating world of rare nickels, the history behind them, and practical tips on what to look for in your change.

Key Highlights

- A rare nickel recently sold for $88,125, showcasing the immense value of collectible coins.

- Coin rarity is influenced by factors such as mint errors, limited production runs, and historical significance.

- Condition and grading play a critical role in determining a coin’s market value.

- Everyday pocket change can occasionally yield rare finds, making awareness key for collectors.

- Understanding design details, mint marks, and production anomalies can help identify valuable coins.

- Rare nickels are part of a broader numismatic market that continues to grow in popularity and investment potential.

The Story Behind the $88,125 Nickel

The nickel that captured headlines with its extraordinary auction price is more than just a piece of metal—it is a slice of history. Coins often gain value due to their rarity, condition, and the story they carry. In this case, the nickel’s uniqueness stemmed from a combination of limited production and distinctive features that set it apart from standard circulation coins. Collectors prize such anomalies because they represent moments when the minting process produced something unusual or rare. For this particular nickel, its scarcity and pristine condition made it a coveted item, driving the price to nearly six figures.

Why Rare Coins Command High Prices

The coin market thrives on rarity and demand. When a coin is produced in limited numbers or contains a minting error, it becomes a target for collectors. The fewer examples available, the higher the potential value. Historical context also plays a role—coins tied to significant events or eras often attract heightened interest. Beyond rarity, condition is paramount. A coin in mint state, showing no signs of wear, can be exponentially more valuable than one in circulated condition. Collectors and investors alike recognize that these factors combine to create a market where certain coins can sell for tens of thousands of dollars.

Understanding Coin Grading and Condition

Grading is the process of evaluating a coin’s condition, and it is central to determining value. Professional grading services use a scale from 1 to 70, with higher numbers indicating better preservation. A coin graded at 65 or above is considered gem quality, often commanding premium prices. Factors assessed during grading include luster, strike quality, and the presence of scratches or blemishes. For the $88,125 nickel, its high grade was a major contributor to its value. Collectors should familiarize themselves with grading standards, as even small differences in condition can lead to significant price variations.

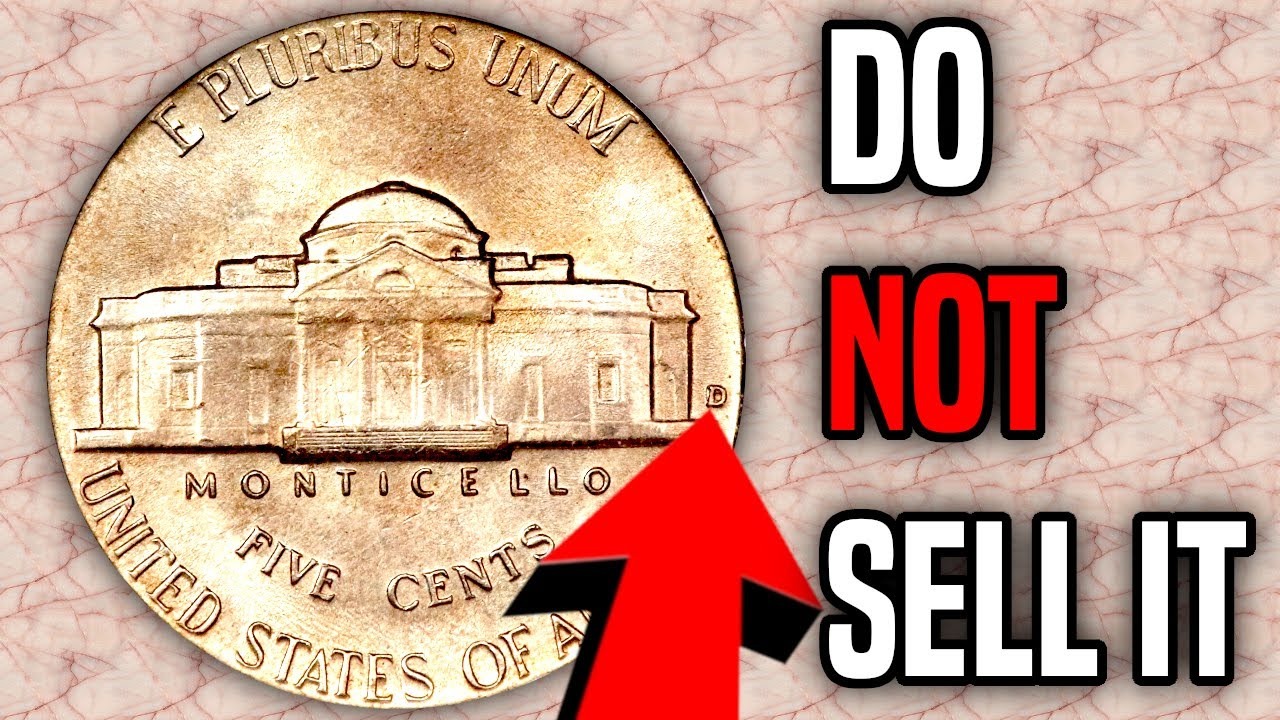

Mint Marks and Their Importance

Mint marks are small letters on coins that indicate where they were produced. For nickels, common mint marks include “P” for Philadelphia, “D” for Denver, and “S” for San Francisco. Some rare coins owe their value to unusual or missing mint marks. For example, a coin struck without its intended mint mark can become a rarity. Collectors often pay close attention to these details, as they can dramatically affect a coin’s desirability. Understanding mint marks is a simple yet powerful way to identify potential treasures in your change.

Common Types of Rare Nickels

Nickels have been minted in various designs over the years, and several types are known for their rarity. The Liberty Head nickel, produced in the late 19th and early 20th centuries, includes the famous 1913 issue—one of the most valuable coins in American history. Buffalo nickels, minted from 1913 to 1938, also contain rare varieties, such as the 1937-D “three-legged” buffalo. Jefferson nickels, introduced in 1938, feature wartime silver-alloy issues that are highly collectible. Each type offers unique opportunities for collectors, and knowing the key dates and varieties is essential for spotting valuable coins.

Table: Comparison of Notable Rare Nickels

| Nickel Type | Key Date/Variety | Distinctive Feature | Approximate Value Range |

|---|---|---|---|

| Liberty Head | 1913 | Extremely limited mintage (5 known) | Millions of dollars |

| Buffalo Nickel | 1937-D Three-Legged | Minting error on buffalo’s leg | $5,000–$100,000+ |

| Jefferson Nickel | 1942–1945 Wartime Issue | Silver alloy composition | $10–$5,000+ |

| Jefferson Nickel | 1950-D | Lowest mintage of series | $20–$20,000+ |

This table illustrates how different nickel varieties can achieve remarkable values depending on rarity, condition, and historical significance.

How to Spot Valuable Coins in Your Change

Finding a rare coin in everyday change is rare but not impossible. The key is awareness. Start by examining coins for unusual features, such as missing mint marks, doubled designs, or odd coloration. Pay attention to dates, as certain years are known for producing rare varieties. Coins that look different from the rest of your change deserve closer inspection. Using a magnifying glass can help identify subtle details that distinguish valuable coins from ordinary ones. While most coins in circulation are common, the occasional discovery of a rarity makes the effort worthwhile.

The Role of Historical Context

Coins are more than currency; they are historical artifacts. The nickel that sold for $88,125 carries with it the story of its era, reflecting the economic and cultural conditions of the time. Collectors often value coins not only for their rarity but also for the history they represent. Wartime nickels, for example, tell the story of resource shortages and adaptations made during World War II. Understanding the historical backdrop of a coin adds depth to its appeal and can increase its desirability among collectors.

Investment Potential of Rare Coins

Rare coins are increasingly viewed as alternative investments. Unlike stocks or bonds, coins offer tangible assets with historical and cultural significance. Their value often appreciates over time, especially for coins with proven rarity and demand. The $88,125 nickel exemplifies how coins can deliver impressive.